For more than a decade, operators have been told the same story: “APIs are the future; telcos must stop being just a pipe.” And yet, despite dozens of whitepapers, standards of bodies, and pilot projects, the API opportunity still feels stuck in PowerPoint mode for most CSPs.

But something has changed in the last 18 months not in technology, but in the business environment around it. Enterprise buyers have become API-native. Regulators increasingly support data sharing under consent frameworks. Fraud, identity theft, and online transactions are exploding. And everyday industries such as banking, retail, logistics, and media now expect programmable infrastructure, not static connectivity.

To put it simply:

There is demand. There is a willingness to pay. And operators are

uniquely positioned to supply.

The real challenge isn’t exposing APIs.

It’s building an

API business, one with

real customers, real products, and real revenue.

This article lays out how operators can make that shift, practically, and without reinventing their entire organization.

The new reality: Operators have high-value capabilities no one else has

Public cloud providers built trillion-dollar businesses by

exposing services as APIs.

CPaaS platforms turned SMS and authentication into

billion-dollar revenue streams.

Developers all over the world are trained to build on top of

standardized building blocks.

But there's one category of capability only operators can provide:

- Real-time device identity & SIM status

- Verified user location

- Network performance, latency, and QoS

- Slicing and edge proximity

- Consent-backed personal data signals

These aren't "nice to have." They're mission critical to industries struggling with:

- Fraud and cybercrime

- Authentication and customer onboarding

- High-performance media

- Logistics and supply chain visibility

- Connected vehicles and industry automation

The global API aggregation model from GSMA Open Gateway to Aduna and regional alliances has removed the fragmentation barrier that held this market back for years.

What operators have today is a once-in-a-generation opportunity to monetize the capabilities they've always owned but never productized.

Where the money is (And where it isn't)

Let's be clear: Not all APIs will make money. Not all APIs deserve product teams.

Based on market traction across Europe, MEA, APAC, and LATAM, three categories consistently emerge as revenue-positive:

A. Identity & Security APIs (Fastest monetization track)

Banks, fintechs, and digital platforms are desperate for trusted, regulated signals:

- SIM Swap

- Number Verification

- Device Status

- Roaming indicators

- Call status

- Silent authentication

These APIs already have paying customers and live deployments in

multiple regions.

They solve a painful problem (fraud) using a data source operator

uniquely control.

B. Location & Context APIs (Broad applicability)

Retailers, logistics companies, and transport apps will pay for:

- Precise device location

- Device-zone presence

- Fraud risk alerts for "device not near transaction"

- Proximity-based actions

Unlike GPS, network location works indoors, underground, or in congested areas.

C. Network Performance APIs (High upside with ecosystem alignment)

This includes:

- QoS on demand

- Slice booking

- Edge discovery / Edge routing

The enterprise appetite is real especially for media, cloud gaming,

and industrial use cases but commercial traction today is slower

because it requires ecosystem partnerships.

Start with identity/security and location. Then scale into network

performance APIs once product/market fit is validated.

Source: Amdocs

The hard truth: What's blocking operators Is NOT technology

Every operator we speak to says the same thing: "It's not the network. It's not the exposure layer. It's everything around it."

Here are the internal blockers that C-suite leaders must address:

1. Contracts take 60–180 days

Legal and procurement treat API products like MVNO deals or IT

projects.

Developers abandon onboarding if the friction is too high.

2. Billing and pricing stacks can't support flexible models

Most billing systems only support:

- Per-call pricing

- Flat monthly subscription

But enterprises want:

- Outcome-based pricing

- Volume tiers

- Pay-per-successful verification

- Bundles

- Freemium trials

Without a modern monetization engine, the commercial opportunity collapses.

3. No clear ownership of the API business

Is it the CTO? CIO? CMO? Chief Digital Officer?

Most telcos don't have a dedicated API P&L owner, so the business never scales.

4. Developers are treated as "users," not customers

API programs fail when the developer portal is seen as an IT asset, not a strategic sales channel.

5. Consent & compliance is an afterthought

Identity and location APIs require bulletproof consent flows.

Without this, the operator can't serve regulated industries.

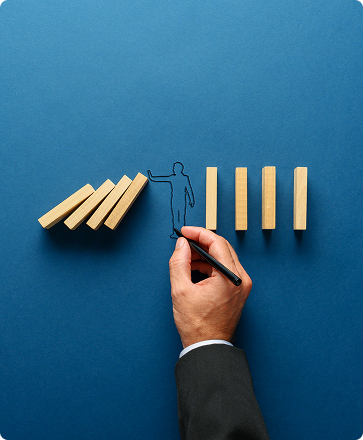

These challenges aren't technical.

They are organizational, commercial, operational, and solvable.

The API platform play: How operators actually win

The goal is not to expose APIs. It's to create a repeatable commercial engine that turns network capabilities into revenue.

Here's what the winning architecture looks like:

1. API exposure layer (the basics)

- Secure, standardized CAMARA-compliant interfaces

- Traffic management, security, throttling

- Usage metrics

Every operator already has or can buy this.

But this layer only accounts for 10% of the monetization

opportunity.

2. Monetization engine (the revenue engine)

This is where money is actually made:

- API product catalog

- Bundling

- Pricing models (subscriptions, usage tiers, outcome-based, dynamic)

- Billing & settlement

- Partner revenue sharing

This determines whether enterprises can actually buy what you expose.

3. Identity & consent framework (the trust engine)

Critical for regulated industries:

- Consent collection

- Consent audit logs

- App identity verification

- API key lifecycle management

Without this, banks won't touch your APIs.

4. Developer experience platform (the growth engine)

Your developer portal is your storefront. It must offer:

- Self-service sandbox

- Instant signup

- Clear documentation

- SDKs & code samples

- Integrated billing

- AI-based troubleshooting assistants

This is how CPaaS platforms win. Operators must compete here or accept second-tier margins.

A practical 12-month roadmap for operators

We recommend a business-first, not "network-first," roadmap which imbibes these 4 key capabilities:

- API exposure & management: Secure endpoint publishing, protocol translation, access controls, usage tracking, rate limiting, monitoring, and analytics.

- Monetization & commerce: API marketplace/catalog, tiered pricing models, subscription management, usage-based billing, revenue sharing, and payment settlement.

- Identity, consent & compliance: User authentication, granular consent capture and storage, permission management, and tools to control which applications can access which APIs.

- Developer experience hub: Documentation library, interactive API console, code samples and SDKs, performance dashboards, support ticketing, and self-service tools (e.g., chatbot assistance).

This roadmap keeps the effort focused and commercially aligned.

What success looks like

A successful operator API business will have:

- A dedicated API P&L owner

- A 2–3 day developer onboarding cycle (not 2–3 months)

- At least one high-traction enterprise vertical, usually banking or fintech

- Subscription-based recurring revenue from identity and security packages

- API bundles tied to premium connectivity (QoS, slicing, edge)

- Multi-channel go-to-market: direct enterprise sales + aggregator distribution

- Consent-compliant, auditable data flows

- A stable release cadence of new APIs every 3–6 months

At this point, the operator is no longer a connectivity provider. They become a trusted programmable network provider invaluable to regulators, enterprises, and digital innovators.

How the right partner accelerates the API platform journey

While operators can and should own the API business internally, the journey requires specialized capabilities in integration, productization, platform engineering, and ecosystem enablement. Successful operators have learned that this transformation accelerates significantly when supported by partners who understand both telecom DNA and digital product thinking.

This is where Torry Harris Integration Solutions (THIS) brings meaningful value.

For more than two decades, THIS has helped telcos modernize their integration landscapes, unlock legacy systems, and build API-led business models with a strong focus on productization over plumbing. Our experience in API governance, marketplace development, and consent-aware data exposure helps operators shorten time-to-market often by months while keeping control of their commercial models.

We also support operators in designing industry-specific API bundles, onboarding enterprise customers, and enabling co-creation programs that turn exposed APIs into real revenue. The goal is not to replace internal teams, but to provide architectural, design, and commercialization expertise that accelerates delivery while reducing risk.

As operators push toward programmable networks and API-first revenue models, having a partner who understands the intersection of platforms, integration, and telecom-grade performance becomes a strategic advantage.

|

Shreya KapoorSenior Content Strategist |